Understanding common financial terms and jargon helps you navigate your finances with confidence. You'll encounter words like assets, which are items you own, and liabilities, representing what you owe. A balance sheet gives a snapshot of your financial position, while cash flow tracks money in and out. Profitability ratios, such as return on investment (ROI), assess how well your money is working for you. Knowing these terms empowers you to make informed decisions and improve your financial literacy. If you're curious about putting this knowledge into practice, you'll find plenty of insights ahead.

Key Takeaways

- Assets are valuable items owned by an individual or business that can provide future economic benefits.

- Liabilities represent financial obligations or debts owed to others, affecting overall financial health.

- The Balance Sheet summarizes a company's financial position, showing the relationship between assets, liabilities, and owners' equity.

- Net Income indicates a company's profitability after deducting all expenses from total revenue over a specific period.

- Cash Flow tracks the movement of cash in and out of a business, essential for assessing liquidity and operational efficiency.

Understanding Financial Terminology

When you immerse yourself in the world of finance, it's important to grasp the key terms that shape a company's financial landscape. Understanding assets and liabilities is fundamental; assets are items owned that provide future benefits, while liabilities are obligations owed to others.

The balance sheet is one of the primary financial statements that illustrates a company's financial position, following the equation Assets = Liabilities + Owners Equity. Additionally, familiarizing yourself with investment options like a Gold IRA can enhance your retirement planning and financial strategy.

Another significant concept is net income, which reflects a company's profitability after all expenses. Profit margin, calculated as (Net Income / Revenue) * 100, shows how efficiently a company manages its costs relative to revenue.

You also need to take into account return on investment (ROI), a performance indicator that helps you evaluate the effectiveness of your investment decisions by comparing net profit to initial costs.

Lastly, cash flow is essential for understanding a business's liquidity and operational viability. It encompasses the net balance of cash inflows and outflows across operating, investing, and financing activities.

Key Financial Concepts Explained

Understanding key financial concepts is essential for making informed decisions in your financial journey. At the heart of this knowledge are assets and liabilities.

Assets can be classified as current assets, which can be converted to cash within a year, or fixed assets, which generate long-term income. Liabilities represent your obligations, categorized into current liabilities due within a year and long-term liabilities.

Additionally, it's important to evaluate how investment vehicles like Bitcoin IRAs can fit into your overall asset strategy, especially given their unique risk profiles and potential for growth in turbulent markets assess personal risk tolerance.

To assess a company's financial health, you'll often look at balance sheets. Here, equity financing comes into play, where raising capital through shares avoids debt but may dilute ownership.

Other important concepts include amortization and depreciation. Amortization spreads the cost of intangible assets over their useful life, helping manage long-term expenses. On the other hand, depreciation accounts for the wear and tear on physical assets, impacting profit margins and net income.

Lastly, understanding the cash flow statement is critical; it provides a snapshot of how money flows in and out of your business, ensuring you have the necessary financial information to make sound decisions.

Familiarizing yourself with these concepts will empower you to navigate your financial landscape effectively.

Importance of Financial Literacy

Financial literacy is essential for anyone looking to take control of their financial future. When you understand personal finance, you're better equipped to make informed financial decisions. This knowledge helps you navigate the complexities of borrowing, investing, and managing financial products.

In today's economic climate, understanding investment strategies in areas like precious metals can further enhance your financial acumen. Here are three key benefits of financial literacy:

- Improved Savings: Financial literacy empowers you to create effective budgets, leading to increased savings and reduced credit card debt.

- Smart Investment Choices: With a solid grasp of financial concepts, you can engage in retirement planning and smarter investment strategies, fostering wealth accumulation over time.

- Fraud Prevention: Knowledgeable consumers are less vulnerable to scams, enhancing overall economic stability for both individuals and communities.

Common Financial Metrics

When you're looking to assess a company's financial health, understanding common financial metrics is essential.

Key performance indicators like ROI and profit margin can reveal a lot about profitability, while liquidity metrics such as the current ratio help you gauge short-term financial stability.

Additionally, being aware of the impact of credit card debt trends can influence your analysis, especially as credit card debt in the U.S. surpassed $930 billion in 2020.

Let's break down these important ratios and what they mean for your financial analysis.

Key Performance Indicators

Key performance indicators (KPIs) are essential tools for evaluating a company's financial health and operational success. These metrics help you assess profitability, cost management, and overall financial performance.

For instance, utilizing KPIs can markedly enhance your top-rated payment solutions by providing insights into transaction efficiency and customer engagement.

Here are three key KPIs you should monitor:

- Return on Investment (ROI): This measures the efficiency of an investment, calculated as (Net Profit / Cost of Investment) x 100. It helps you determine how well your investments are performing.

- Profit Margin: This indicates how much profit you make for every dollar of revenue, expressed as a percentage: (Net Income / Revenue) x 100. It provides insights into your pricing strategies and cost management.

- Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA): This metric focuses on operational efficiency, highlighting your company's profitability without the influence of capital structure.

Additionally, the Current Ratio assesses your ability to pay short-term obligations by dividing current assets by current liabilities.

Monitoring these KPIs will give you a clearer picture of your company's profitability, liquidity, and financial health, enabling better decision-making for future investments.

Profitability Ratios Explained

Understanding the various profitability ratios can greatly enhance your ability to gauge a company's financial performance. These ratios help you analyze how well a company converts revenue into profit and assess its overall financial health.

| Ratio | Description |

|---|---|

| Profit Margin | Measures profitability as a percentage of revenue. |

| Gross Profit Margin | Reflects efficiency in production, showing revenue over COGS. |

| Operating Margin | Indicates operational efficiency post-expenses. |

| Net Profit Margin | Shows overall profitability after all expenses. |

| Return on Equity (ROE) | Assesses how effectively equity is used to generate profit. |

Each of these ratios provides insight into different aspects of profitability. For instance, the net profit margin indicates how much net income remains from total revenue, while the return on equity highlights how well a company utilizes shareholders' equity. Understanding these metrics can help you make informed investment decisions and evaluate a company's profitability against its peers. By focusing on these key ratios, you can gain a clearer picture of a company's financial performance and its value to shareholders.

Liquidity Metrics Overview

Liquidity metrics play an essential role in evaluating a company's financial health, especially in its ability to meet short-term obligations. Understanding these metrics can help you assess how well a company manages its current assets and liabilities.

In the same way that strong problem-solving skills enhance issue resolution in SQA careers, these financial ratios provide critical insights into a company's operational efficiency. Here are three key liquidity ratios to evaluate:

- Liquidity Ratio: This measures a company's ability to cover short-term obligations, calculated as current assets divided by current liabilities. Ideally, it should be above 1.0 for financial stability.

- Quick Ratio: Also known as the acid-test ratio, it provides a more rigorous view of financial health by excluding inventory. It's calculated as (current assets – inventory) / current liabilities.

- Cash Ratio: This is the most conservative metric, calculated as cash and cash equivalents divided by current liabilities, showing the company's ability to pay off short-term debts using its most liquid assets.

Additionally, you might regard the operating cash flow ratio, which indicates how well cash generated from core operations covers current liabilities.

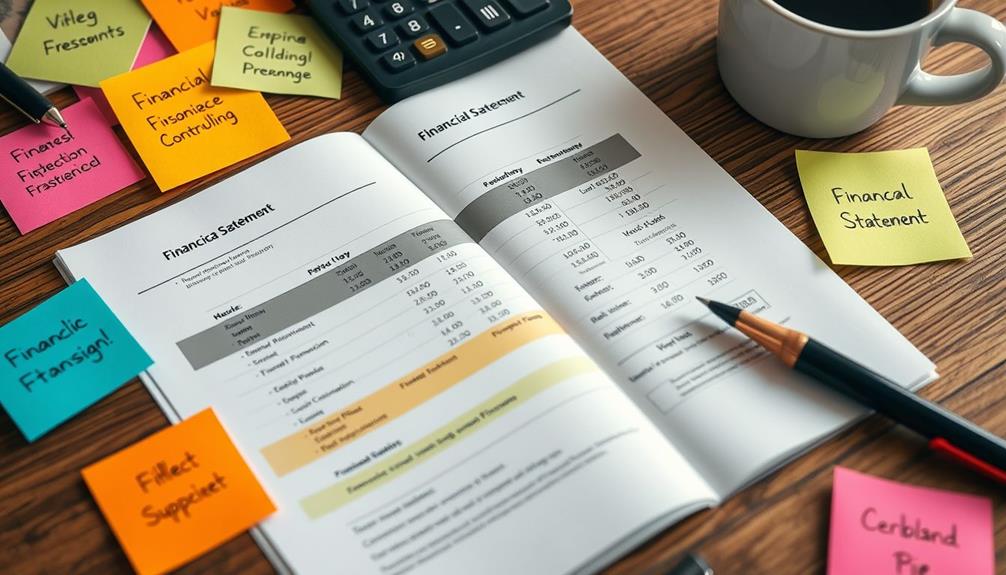

Navigating Financial Statements

How do you make sense of a company's financial statements? Understanding these documents is essential for evaluating its financial health. You'll typically encounter three main statements: the balance sheet, income statement, and cash flow statement. Each serves a unique purpose.

Here's a quick breakdown:

| Financial Statement | Key Focus |

|---|---|

| Balance Sheet | Assets, Liabilities, Shareholders Equity |

| Income Statement | Revenues, Expenses, Gross Profit |

| Cash Flow Statement | Cash Inflows and Outflows |

The balance sheet gives you a snapshot of a company's financial position at a specific moment, showing total assets, liabilities, and shareholders' equity. The income statement, also known as the profit and loss statement, summarizes revenues and expenses over a period, highlighting gross profit and overall profitability. Finally, the cash flow statement tracks cash movements, allowing you to assess liquidity and financial health. By traversing these statements, you can gain valuable insights into a company's financial position and performance, making informed decisions about your investments or business dealings.

Strategies for Effective Budgeting

What's the best way to manage your finances effectively? It starts with setting clear financial goals. This could mean saving for emergencies, retirement, or major purchases, which helps you focus on the allocation of resources.

For those considering retirement strategies, investing in a Gold IRA can be a beneficial option, especially with firms known for strong customer satisfaction like Augusta Precious Metals.

Here are three strategies to enhance your budgeting:

- Use the 50/30/20 Rule: Allocate 50% of your income to needs, 30% to wants, and 20% to savings and debt repayment. This promotes balanced financial health.

- Track Expenses Regularly: Utilize budgeting apps or spreadsheets to keep an eye on your spending patterns. This practice helps you make necessary adjustments to align with your financial goals.

- Implement Zero-Based Budgeting: Assign every dollar a purpose so that all income is utilized effectively. This method fosters accountability and guarantees you're in control of your financial performance.

Review and adjust your budget monthly to gain insights into your financial health and recognize areas for improvement.

Frequently Asked Questions

What Are the Basic Financial Jargons?

You'll encounter terms like assets, liabilities, equity, cash flow, and profit margin. Understanding these basics helps you navigate financial discussions and make informed decisions, whether in personal finance or managing a business.

Can You Explain Financing Terms to Me?

When you explore financing terms, think about how equity financing raises capital without debt, while debt consolidation simplifies payments. Understanding cash flow, ROI, and working capital can really help you manage your finances effectively.

What Are Some of the Key Vocabulary Words for Financial Literacy?

To boost your financial literacy, focus on key terms like assets, liabilities, equity, net worth, and cash flow. Understanding these concepts helps you make informed decisions about your personal finances and investments.

What Are Some of the Key Vocabulary Words for Financial Literacy?

To boost your financial literacy, focus on key terms like assets, liabilities, equity, net worth, and cash flow. Understanding these concepts helps you make informed decisions and manage your personal or business finances effectively.

Conclusion

As you dive deeper into the world of finance, you'll find that understanding these terms and concepts can open doors you never knew existed. Coincidentally, the more you grasp these ideas, the more empowered you become in making informed decisions. Financial literacy isn't just about numbers; it's about seizing opportunities and building a secure future. So, keep exploring, keep learning, and watch how your newfound knowledge transforms your financial journey into a rewarding adventure.