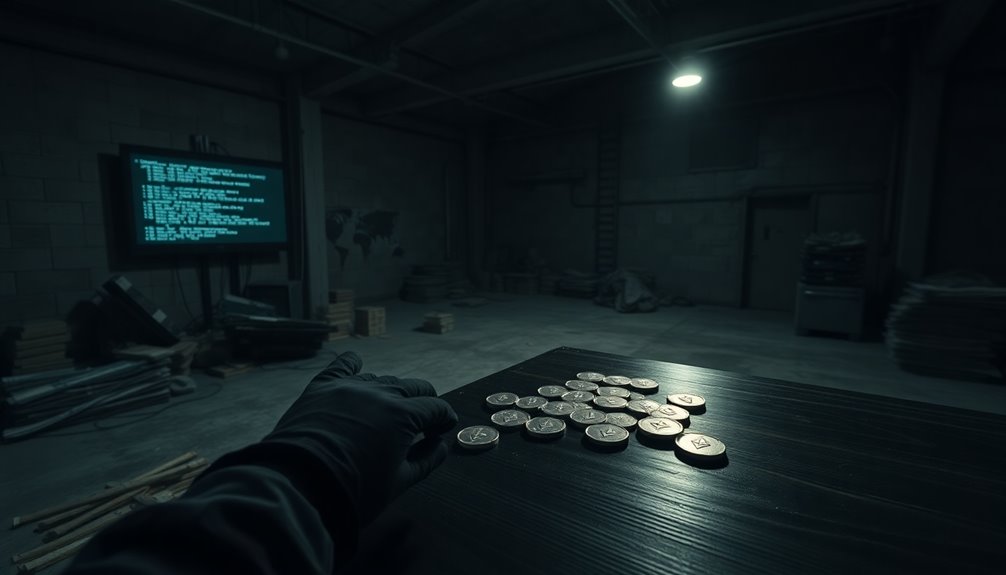

In the aftermath of the Bybit hack, you've likely heard about the staggering amounts of stolen ETH that have been laundered. With over $335 million moved through various techniques, the hackers have cleverly obscured their tracks. This situation raises critical questions about the effectiveness of current security measures and the ongoing struggle to trace illicit funds in the crypto world. What does this mean for the future of cryptocurrency security and regulation?

In the wake of the unprecedented Bybit hack on February 21, 2025, which saw the theft of approximately $1.4 billion to $1.5 billion in assets, the cryptocurrency industry is grappling with the fallout. The hackers, suspected to be linked to the notorious Lazarus Group from North Korea, employed social engineering and supply chain attacks to compromise Bybit's Ethereum multisig cold wallet.

With the initial transfer of funds moving to an address starting with '0x4766', the sheer scale of this breach has left many in the crypto community shaken.

As you follow the developments, you'll find that hackers have already laundered over $335 million of the stolen funds. They've utilized decentralized exchanges (DEXs), mixers, and cross-chain bridges to obscure the trail of the stolen assets. For instance, more than 5,000 ETH has passed through the eXch Mixer, effectively making it harder for authorities to track down the illicit funds.

The remaining stolen amount, approximately $900 million, still poses a significant challenge, with the potential for further laundering as the hackers continue to exploit various methods. Bybit fully restored its withdrawal system, ensuring that clients can access their funds without delays or restrictions.

The industry's response has been swift yet complex. Bybit assures its customers that their balances are secure and that the exchange is covering any losses from its reserves. However, with the laundering of such a massive sum, the urgency to recover stolen assets has intensified.

Blockchain transparency plays a crucial role here, as the public ledger allows investigators to trace the movement of these funds. Collaborations among exchanges and the involvement of blockchain analysts are essential in the ongoing efforts to freeze and recover what's left of the stolen assets.

You should also be aware of the broader implications this incident has on the cryptocurrency landscape. The hack has triggered a wave of regulatory scrutiny, prompting discussions about stricter regulations for exchanges.

Financial losses for Bybit and the market's reaction, including a decline in major cryptocurrency prices, highlight the vulnerability of the industry. As you consider the future, it's clear that enhanced security measures are vital.

There's a pressing need for improved supply chain security and stronger safeguards for multisig wallets to prevent similar attacks.

As a participant in this evolving space, you might want to keep an eye on how inter-exchange cooperation and blockchain intelligence can shape a more secure environment moving forward. The aftermath of the Bybit hack serves as a crucial reminder of the need for vigilance and innovation in protecting digital assets.